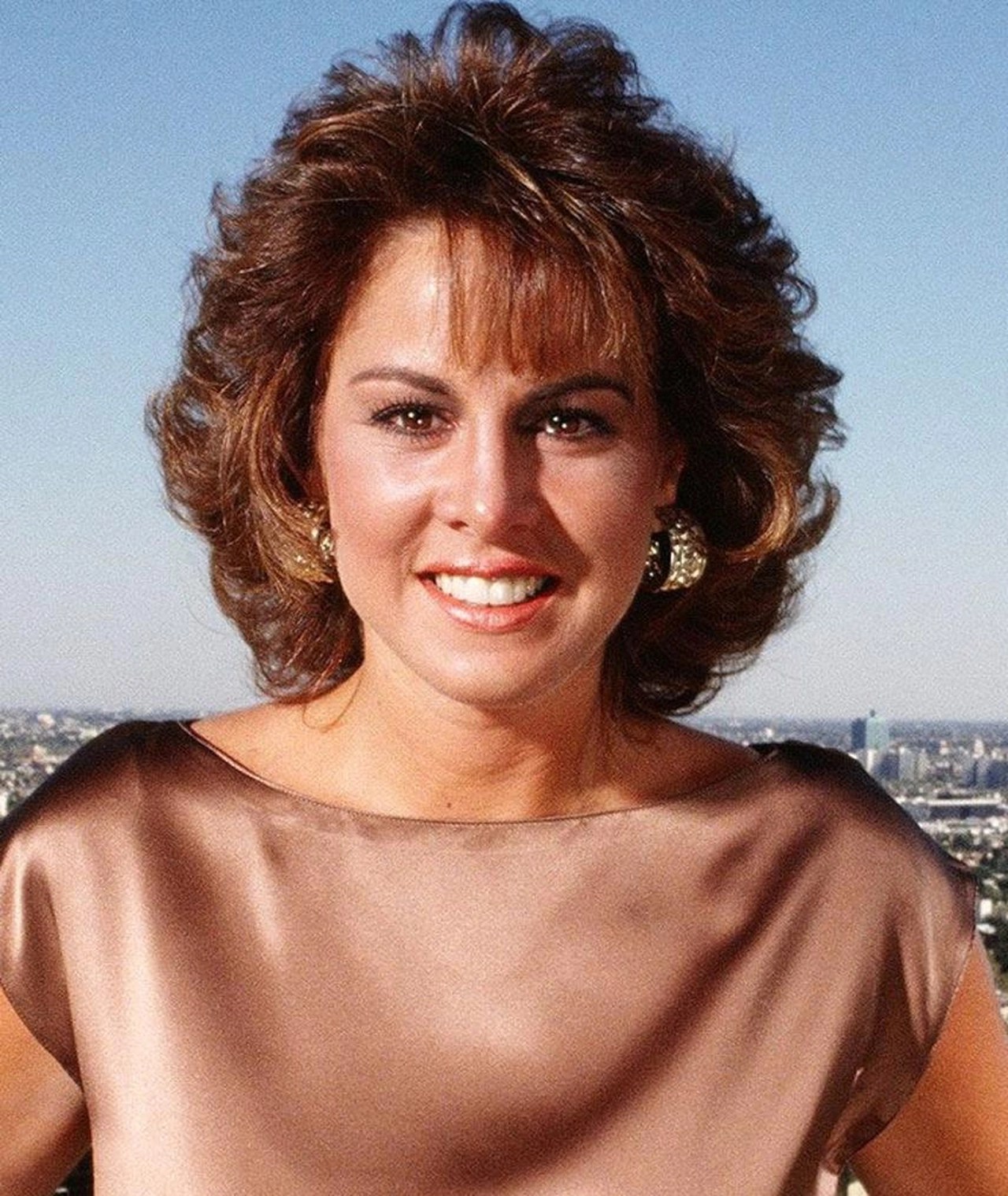

Unveiling Jessica Hahn's Net Worth: Insights And Surprises Revealed

Jessica Hahn's net worth refers to the total value of her assets and income, minus her liabilities and debts. It is a measure of her financial worth at a specific point in time.

Jessica Hahn's net worth is significant because it provides insights into her financial success and wealth. It can be used to compare her financial standing to others in her industry or to track her financial progress over time.

In this article, we will explore Jessica Hahn's net worth, including her sources of income, her spending habits, and her financial goals.

Jessica Hahn's Net Worth

Jessica Hahn's net worth, a measure of her financial wealth, encompasses various aspects that contribute to her overall financial standing. These key aspects include:

- Assets: Properties, investments, and valuable possessions

- Income: Earnings from her career and other sources

- Liabilities: Debts and financial obligations

- Investments: Strategies to grow her wealth

- Spending: Expenses and financial outlays

- Financial Goals: Targets and aspirations for her financial future

- Tax Implications: Impact of taxes on her net worth

- Estate Planning: Arrangements for the distribution of her assets after her death

- Net Worth Tracking: Monitoring and managing her financial position

Understanding these aspects provides a comprehensive view of Jessica Hahn's financial well-being. It allows for informed decision-making, financial planning, and wealth management strategies tailored to her specific circumstances and objectives.

Assets

Assets encompass the valuable resources and properties owned by Jessica Hahn. These assets significantly contribute to her net worth, representing her financial strength and stability.

- Real Estate: Properties such as land, residential and commercial buildings, and vacation homes form a substantial portion of Jessica Hahn's assets. Their value appreciates over time, contributing to the growth of her net worth and providing potential rental income.

- Investments: Jessica Hahn's investments include stocks, bonds, mutual funds, and private equity. These investments generate passive income through dividends, interest, and capital appreciation. Diversifying her investment portfolio helps manage risk and maximize returns.

- Valuable Possessions: Collectibles, artwork, jewelry, and other valuable items hold intrinsic or sentimental value. While not as liquid as other assets, they can contribute to Jessica Hahn's overall net worth and provide diversification.

In summary, Jessica Hahn's assets, including properties, investments, and valuable possessions, play a crucial role in determining her net worth. These assets represent her accumulated wealth and serve as a foundation for her financial security and future growth.

Income

Income is a crucial factor that directly impacts Jessica Hahn's net worth. It represents the inflow of funds from various sources, including her professional endeavors and other income-generating activities.

- Career Earnings: Jessica Hahn's primary source of income is her successful career in the entertainment industry. Her earnings from acting, modeling, and other related activities contribute significantly to her net worth. Stable and consistent career earnings provide a solid foundation for her financial growth.

- Investments and Dividends: Jessica Hahn's investments in stocks, bonds, and other financial instruments generate passive income through dividends and interest payments. These investments supplement her career earnings and provide a steady stream of income.

- Endorsements and Sponsorships: Jessica Hahn's popularity and influence in the industry have led to endorsement deals and sponsorships with various brands and companies. These partnerships provide additional income and can enhance her overall net worth.

- Business Ventures: Jessica Hahn may engage in entrepreneurial activities, such as starting her own businesses or investing in startups. The success of these ventures can further increase her income and contribute to her net worth.

In summary, Jessica Hahn's income from her career, investments, endorsements, and business ventures plays a pivotal role in determining her net worth. Diversifying her income streams provides financial stability, allows for wealth accumulation, and contributes to her overall financial well-being.

Liabilities

Jessica Hahn's liabilities, referring to her debts and financial obligations, play a crucial role in determining her net worth. Liabilities represent the financial responsibilities she owes to external parties and creditors, directly impacting her overall financial standing.

- Mortgages and Loans: Mortgages on properties and loans for various purposes, such as business investments or personal expenses, contribute to Jessica Hahn's liabilities. These debts typically carry interest charges, affecting her cash flow and overall net worth.

- Credit Card Debt: Credit card balances, if not managed prudently, can accumulate interest and late payment fees, becoming a significant liability. Managing credit card debt effectively is essential for maintaining a healthy net worth.

- Taxes Payable: Taxes owed to government entities, such as income tax, property tax, and sales tax, are considered liabilities until they are settled. Timely payment of taxes is crucial to avoid penalties and maintain a positive financial standing.

- Business Liabilities: If Jessica Hahn owns or invests in businesses, she may incur liabilities related to the operations of those businesses. These liabilities can include outstanding payments to suppliers, employee salaries, and other expenses.

Effectively managing liabilities is crucial for Jessica Hahn's financial stability and growth. By keeping liabilities under control, maximizing income, and strategically utilizing assets, she can optimize her net worth and achieve her long-term financial goals.

Investments

Investments play a crucial role in growing Jessica Hahn's net worth, providing her with opportunities to multiply her wealth and secure her financial future. Her investment strategies encompass a range of approaches aimed at maximizing returns and minimizing risks.

- Diversification: Jessica Hahn's investment portfolio is diversified across various asset classes, such as stocks, bonds, real estate, and alternative investments. Diversification helps spread risk and potentially enhances overall returns by reducing the impact of volatility in any single asset class.

- Long-Term Focus: Jessica Hahn adopts a long-term investment horizon, recognizing that wealth accumulation is a gradual process. She invests with a focus on the potential for long-term growth rather than short-term gains, allowing her investments to compound over time.

- Asset Allocation: Jessica Hahn's investment strategy involves allocating her assets based on her risk tolerance, time horizon, and financial goals. She carefully considers the proportion of her portfolio allocated to each asset class, ensuring alignment with her overall financial objectives.

- Regular Reviews and Rebalancing: Jessica Hahn periodically reviews her investment portfolio and makes adjustments as needed. She rebalances her portfolio to maintain her desired asset allocation and risk profile, ensuring that her investments remain aligned with her evolving financial situation and goals.

By implementing these investment strategies, Jessica Hahn seeks to maximize her wealth by leveraging market opportunities, managing risks, and aligning her investments with her long-term financial aspirations.

Spending

Spending, encompassing expenses and financial outlays, directly influences Jessica Hahn's net worth. It represents the outflow of funds used for various purposes, impacting her overall financial position.

- Living Expenses: Jessica Hahn's daily living expenses, including housing, food, transportation, and personal care, impact her net worth. Managing these expenses prudently allows her to allocate more funds towards savings and investments.

- Discretionary Spending: Jessica Hahn's discretionary spending includes entertainment, travel, and luxury items. While these expenses can enhance her lifestyle, excessive spending can hinder her ability to accumulate wealth.

- Investments: Jessica Hahn's investments, while not typically considered expenses, require financial outlays. Investing in assets such as real estate, stocks, or bonds can increase her net worth over time, but it also involves potential risks and fluctuations.

- Taxes: Jessica Hahn's tax obligations, such as income tax and property tax, reduce her net worth. Understanding and planning for tax implications is essential for making informed financial decisions.

Effective management of spending is crucial for Jessica Hahn to optimize her net worth. By balancing essential expenses, discretionary spending, and investments, she can allocate her financial resources strategically, allowing her to build wealth and secure her financial future.

Financial Goals

Establishing clear financial goals is crucial in shaping Jessica Hahn's net worth and driving her financial decisions. These goals serve as targets and aspirations that guide her financial planning and investment strategies.

- Retirement Planning: Jessica Hahn's retirement goals involve securing her financial future by accumulating sufficient wealth to maintain her desired lifestyle after leaving the workforce. This goal influences her investment decisions and savings strategies, ensuring she has a comfortable retirement.

- Financial Independence: Achieving financial independence is a key aspiration for Jessica Hahn, where she aims to generate passive income streams that cover her expenses, allowing her to pursue her passions and interests without relying solely on employment income.

- Wealth Creation: Jessica Hahn's financial goals extend beyond financial independence, encompassing wealth creation through savvy investments and business ventures. This goal drives her to explore opportunities that have the potential to multiply her net worth.

- Legacy Planning: Jessica Hahn may consider legacy planning as part of her financial goals, ensuring that her wealth is distributed according to her wishes after her passing. This involves estate planning and charitable giving, shaping the impact of her net worth beyond her lifetime.

By aligning her financial decisions with her well-defined goals, Jessica Hahn increases the likelihood of achieving her financial aspirations and building a secure financial future.

Tax Implications

Taxes play a significant role in determining Jessica Hahn's net worth. As income increases, so does her tax liability, which directly impacts the amount of wealth she accumulates. Understanding the tax implications on her income and investments is crucial for effective financial planning and wealth management.

For example, if Jessica Hahn earns a substantial income from her acting career, a portion of her earnings will be subject to income tax. The amount of tax she pays will depend on her tax bracket and applicable deductions. Additionally, if she invests in stocks or real estate, she may incur capital gains tax when she sells those assets. These taxes can significantly reduce her net worth if not properly accounted for.

Therefore, it is essential for Jessica Hahn to consider tax implications when making financial decisions. By working with a qualified accountant or financial advisor, she can optimize her tax strategy, minimize her tax liability, and maximize her net worth. This understanding empowers her to make informed choices that align with her long-term financial goals.

Estate Planning

Estate planning plays a crucial role in determining the trajectory of Jessica Hahn's net worth beyond her lifetime. It involves making arrangements for the distribution of her assets after her death, ensuring that her wealth is managed and distributed according to her wishes.

- Wills and Trusts: Jessica Hahn can create a will or establish a trust to outline her wishes for the distribution of her assets after her death. This legal document ensures that her wealth is distributed according to her intentions, minimizing the risk of disputes among heirs.

- Beneficiary Designations: Jessica Hahn can designate beneficiaries for her retirement accounts, life insurance policies, and other financial assets. These designations override any instructions in her will, ensuring that these assets are distributed directly to her chosen beneficiaries.

- Tax Planning: Estate planning allows Jessica Hahn to minimize the tax burden on her heirs. By utilizing various tax-saving strategies, such as charitable giving and trusts, she can reduce the amount of taxes that her estate will be liable for.

- Legacy Planning: Through estate planning, Jessica Hahn can make provisions for her legacy. She can establish charitable foundations or donate assets to causes that are important to her, ensuring that her wealth continues to make a positive impact beyond her lifetime.

By engaging in comprehensive estate planning, Jessica Hahn can safeguard her net worth, ensure the distribution of her assets according to her wishes, and create a lasting legacy that reflects her values and aspirations.

Net Worth Tracking

Net worth tracking is a crucial aspect of managing Jessica Hahn's financial position. It involves regularly monitoring her assets, liabilities, and income to assess her overall financial health. By tracking her net worth, Jessica Hahn can make informed decisions about her spending, investments, and financial goals.

For instance, Jessica Hahn may use net worth tracking to identify areas where she can reduce her expenses or increase her income. This information can help her create a budget and develop strategies to improve her financial situation. Additionally, net worth tracking allows Jessica Hahn to assess the performance of her investments and make adjustments as needed to optimize her portfolio.

Overall, net worth tracking is an essential tool for Jessica Hahn to monitor and manage her financial position. It provides her with a comprehensive view of her financial situation, allowing her to make informed decisions and achieve her long-term financial goals.

FAQs about Jessica Hahn's Net Worth

Jessica Hahn's net worth has been a subject of interest and speculation. Here are answers to some frequently asked questions about her financial standing:

Question 1: What is Jessica Hahn's estimated net worth?

Jessica Hahn's net worth is estimated to be around $1 million to $5 million. This estimation considers her earnings from her acting career, modeling, endorsements, and investments.

Question 2: How has Jessica Hahn accumulated her wealth?

Jessica Hahn's wealth primarily comes from her successful career in the entertainment industry. She has starred in numerous films and television shows, and her modeling work has also contributed to her earnings. Additionally, she has made wise investments that have grown her net worth over time.

Question 3: What are Jessica Hahn's primary sources of income?

Jessica Hahn's primary sources of income include her acting and modeling fees. She also earns money through endorsements, sponsorships, and royalties from her work in the entertainment industry.

Question 4: How does Jessica Hahn manage her finances?

Jessica Hahn reportedly has a team of financial advisors who assist her in managing her finances. She is known for being financially savvy and making calculated investments that have contributed to her wealth.

Question 5: What are Jessica Hahn's financial goals?

Jessica Hahn's financial goals are not publicly known, but it is speculated that she aims to secure her financial future and continue growing her wealth through her career and investments.

Question 6: What is the significance of Jessica Hahn's net worth?

Jessica Hahn's net worth is a reflection of her financial success and achievements in the entertainment industry. It serves as an indicator of her earning power and her ability to generate wealth through her talents and business ventures.

In summary, Jessica Hahn's net worth is a result of her hard work, smart investments, and financial acumen. Her financial standing is a testament to her success in the entertainment industry and her ability to manage her finances effectively.

Transition to the next article section:

Tips to Enhance Your Financial Well-being

Inspired by the financial journey of Jessica Hahn, here are some valuable tips to help you improve your financial well-being:

Tip 1: Set Clear Financial GoalsDefine specific, measurable, achievable, relevant, and time-bound financial goals. This clarity will guide your financial decision-making and keep you motivated on your path to financial success.

Tip 2: Create a Comprehensive BudgetTrack your income and expenses meticulously. Categorize your expenses to identify areas where you can optimize your spending. Sticking to a budget will empower you to control your finances and allocate funds effectively.

Tip 3: Invest WiselyExplore various investment options that align with your risk tolerance and financial goals. Diversify your portfolio to spread risk and maximize potential returns. Consider seeking professional financial advice to make informed investment decisions.

Tip 4: Manage Debt EffectivelyAvoid unnecessary debt and pay off existing debts strategically. Prioritize high-interest debts and consider debt consolidation to reduce interest payments and improve your credit score.

Tip 5: Protect Your AssetsObtain adequate insurance coverage to protect your valuable assets, such as health, life, and property. This will provide financial security and peace of mind in case of unforeseen events.

Tip 6: Plan for Retirement EarlyStart saving for retirement as early as possible. Utilize tax-advantaged retirement accounts and consider additional investments to supplement your retirement income.

Tip 7: Seek Professional Financial AdviceWhen needed, don't hesitate to seek guidance from a qualified financial advisor. They can provide personalized advice, help you navigate complex financial decisions, and keep you on track towards your financial objectives.

By incorporating these tips into your financial strategy, you can emulate the financial success of Jessica Hahn and achieve your own financial aspirations.

Transition to the article's conclusion

Conclusion

Jessica Hahn's net worth serves as a testament to her financial acumen and success in the entertainment industry. Her journey highlights the importance of setting clear financial goals, making smart investments, and managing finances effectively.

To emulate Jessica Hahn's financial success, individuals should prioritize financial planning, create a comprehensive budget, and invest wisely. Seeking professional financial advice can also provide valuable guidance and support. By implementing these strategies, you can enhance your financial well-being and achieve your own financial aspirations.

Unveiling The Truth Behind "Mike Shouhed Naked": An Eye-Opening Journey

Discover The Enchanting World Of Mom & Daughter Matching Pajamas

Unveiling Ashley Moore's Ethnicity: A Tapestry Of Culture And Empowerment

ncG1vNJzZmikkaKvsLTOpGxnmZ2ogG%2BwyKCgrZmcpLCmrc2sp5qblah7pLvMaKGeq6OesKJ5x5qfp2WemsFuw86rq6FmmKm6rQ%3D%3D